Source: Zhitong Finance APP

At the beginning of 2024, due to the gradually weakening of the market’s expectations of the central bank’s interest rate cuts, the total sales of commercial real estate in Europe fell to the lowest level in 13 years, which reflected the persistent sluggish in the real estate market.

In recent years, the European commercial real estate industry has been hit by a sharp rise in debt costs and a sharp decline in house prices.Especially after the epidemic, some office buildings and business areas have become unrestrained and the situation is becoming more severe.

While global investors re -evaluate when the central bank may start to cut interest rates, the hope of real estate and other industries that are extremely sensitive to interest rates are suppressed.

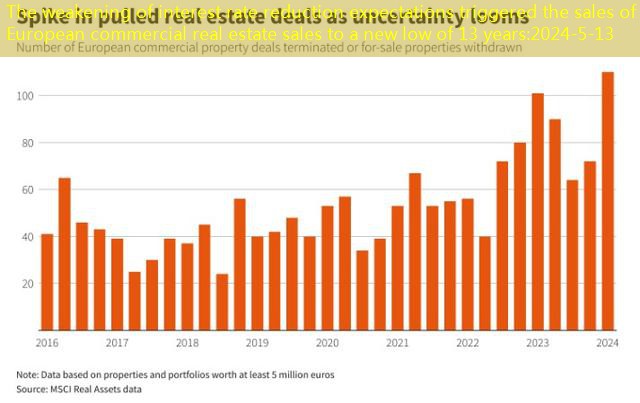

According to data from MSCI Real Assets, real estate transactions worth more than 5 million euros (about $ 5.4 million) this quarter have been terminated.Record.These data show that there are high instability and uncertainty in the market, which has led to many high -value transactions that fail to complete, and a large number of real estate has been withdrawn from the sales market.

At the same time, the total sales of commercial real estate in Europe in the first quarter of 2024 decreased by 26%year -on -year to 34.5 billion euros. This is the lowest point since 2011, and it also marks the seventh consecutive quarter of annual decline.

In addition, the research of Green Street pointed out that compared with the peak period of 2022, the value of European office buildings has fallen by about 37%average, while the prices of residential and industrial real estate have fallen by about 20%.Although some owners were forced to sell their real estate due to debt pressure, many owners were unwilling to achieve losses when the market trough.High net worth investors with debt -free burden have driven most of the recent transactions, although these are usually limited to small -scale transactions.

Despite the decline in overall sales, London is still the largest investment destination in Europe.The price adjustment of Britain has attracted investors to re -enter the market to find low -cost assets.However, there were two attractive office transactions in this quarter.The two transactions were sold at the price of 20 Old Bailey for £ 240 million, and the 5 Churchill Place at the Golden Silk Wharf was taken over by £ 110 million.Some people in the market believe that this is a signal, indicating that sellers may get better prices after waiting for the Bank of England to further reduce the cost of borrowing.

”From the perspective of statistical data, the market conditions in the first quarter of the London Capital Market Director of London London said that the market conditions in the first quarter were quite bad. But in fact, this does not fully reflect what happened outside the market.”Different differences.” He pointed out that private equity groups are joining the ranks of the family office and are expected to promote more trading activities in the next six months.

In contrast, Tom Leahy, the director of Real Estate Research, MSCI Europe, the Middle East and African real estate research, believes: “After experiencing a very slow 2023 years, we hope to see the rise of European real estate investment … However, the market is still in difficulty in transaction.”